Property taxes are essential for local governments to raise money to pay for things like schools, roads, and emergency services. Property taxes are a major funding source for local governments in the US. The US ranks among the countries with the highest property taxes in the world, according to the OECD report on property taxes. This is because local governments in the US rely more on property taxes than national or state governments, which often use other types of taxes to fund their activities.

You must pay property taxes yearly if you own a home or property in the US. But how do these taxes work? What makes your tax bill high or low? And how can you cut down on what you owe? Let’s break it down in a simple way, with examples that are easy to understand.

What Property Taxes Are and How They Work in the US

In the US, real estate taxes are taxes that owners are charged according to the worth of their houses. If you own a home or any real estate, you’re responsible for paying these taxes every year. But what determines how much you’ll pay? Your property tax depends on several things:

- The value of your place.

- The local tax rate (set by your area’s government).

- What type of place do you own (home or business)?

- Exemptions or deductions you may qualify for (like for seniors or veterans).

Now, let’s break down how property taxes are calculated so you can see exactly how your tax bill is determined.

How Are Property Taxes Calculated?

You can also use an online property tax calculator to estimate your taxes based on your property’s value and the local tax rate. Many local county websites, such as Cook County Assessor’s Office, Los Angeles County, or Hennepin County, provide these calculators to help homeowners understand what they might owe.

However, we will use simple examples and clear numbers to explain how property taxes are calculated step by step.

1. Property Tax Assessment

First, local government officials determine the worth of your place. This process is called a property tax assessment. They look at factors like:

- The size of your home or property.

- The location (some places are worth more because of their proximity to schools, shopping, or jobs).

- The condition of the property.

- Recent sales of similar houses in your neighborhood

For example, if you own a house in a neighborhood where similar houses recently sold for $200,000, the government may also assess your home’s value at around $200,000.

2. Tax Rates

Once the value of your home is determined, the local authorities apply a tax rate. The local county, city, or state usually sets the tax rate, often a small percentage of your property’s value, sometimes called a “mill rate.” The tax rate differs depending on your location.

Let’s see how the National Association of Counties teaches Americans to calculate taxes. For example, let’s say your home is assessed at $200,000, and the tax rate in your area is 2%. To find out your property tax, just take your home’s value and apply the tax rate: $200,000 x 0.02 = $4,000

So, in this example, you would owe $4,000 in property taxes for the year.

3. How Taxes Are Used

Local authorities use the funds gathered from property taxes to pay for public safety and infrastructure. As stated by the Tax Foundation, these funds are a significant way that local governments raise money for things like:

- Public schools (funding teachers, facilities, and materials).

- Emergency services (firefighters, police officers).

- Road maintenance (paving streets, fixing potholes).

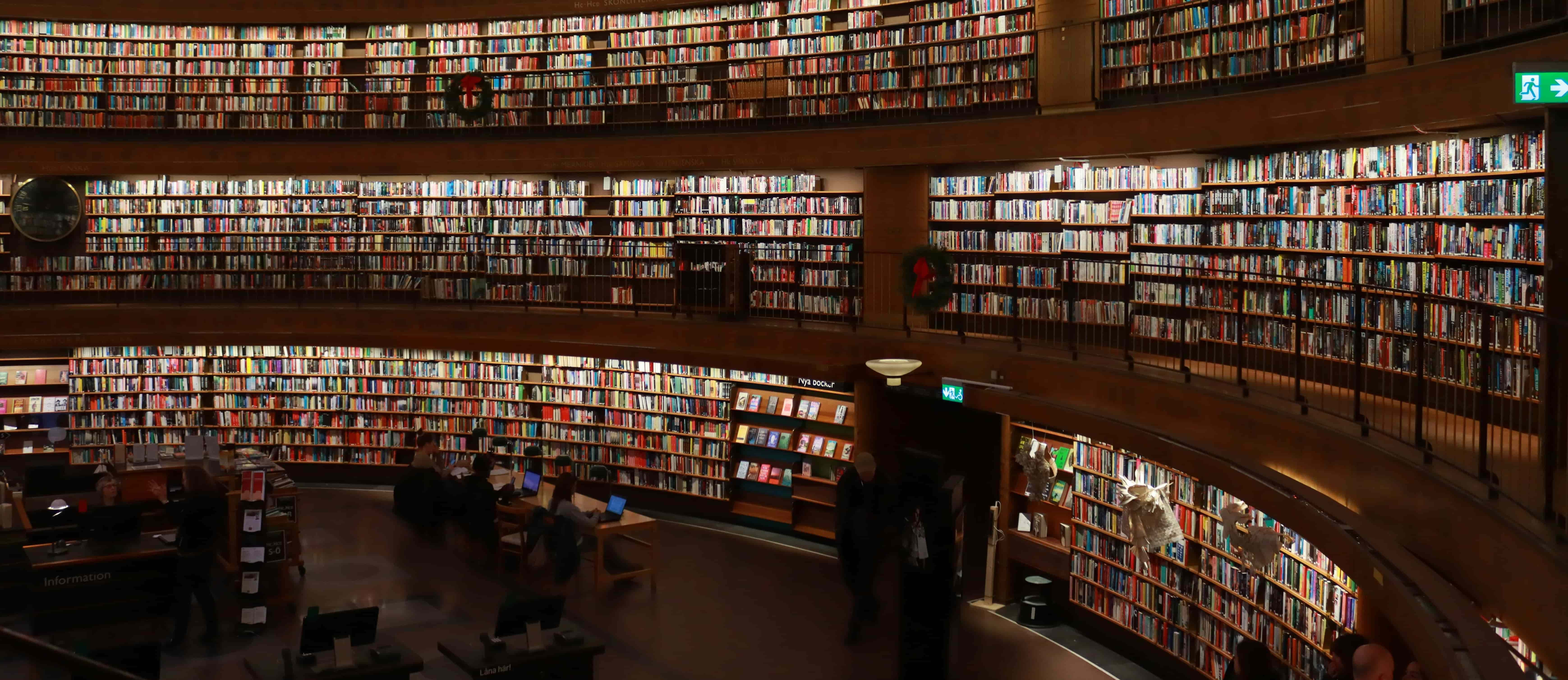

- Libraries and parks (keeping them open and maintained).

Property taxes can also fund public health services or local government offices in some areas. Local governments rely heavily on these taxes because they don’t always receive enough money from the federal or state governments.

Property Tax Rates in States and Counties

How much property tax you pay depends largely on where you live. Some states and counties have higher rates than others. According to recent statistics, the area with the highest property tax rates is New Jersey, while the lowest rates can be found in Hawaii. To help you understand how taxes vary across the U.S., we used a popular property tax calculator to gather data and create the table below.

Table: Average Сounty Tax Rates in the US

The property tax rate for a home worth $200,000 could be $4,200 in Cook County or Dallas County but only $1,760 in New York City. This highlights how the property tax rate can vary significantly from one place to another.

Property Taxes in Popular Counties

Different regions in the US have varying property tax rates, influencing where people live. Let’s explore some popular counties and see how their property tax systems work, focusing on the rates, calculations, and available deductions.

Cook County Property Tax

Cook County, home to Chicago, is known for having fairly high property taxes. The property tax rate in Cook County is approximately 2.1%. Do you see it? This amount is higher than in many other areas. If your home is worth $200,000, you pay around $4,200 in property taxes yearly. For a home worth $250,000, the annual tax would be about $5,250.

Why Are Taxes High in Cook County?

The need to fund essential public services drives Cook County’s high property taxes. Here are the primary reasons, explained with general figures:

- Public Services Spending: About 50-60% of property tax revenue in Cook County goes to fund public services like schools, police, and infrastructure. For example, if you pay $5,000 in property taxes annually, approximately $2,500 to $3,000 supports these services.

- Pension Obligations: The county’s pension obligations have increased significantly. Pension costs now account for roughly 20-25% of the budget, adding financial pressure and increasing tax rates.

- Budget Deficits: Persistent budget shortfalls require higher taxes to balance the budget. The county has recently faced annual deficits ranging from $10 million to $20 million.

These combined factors lead to Cook County’s average property tax rate of around 2.1%, higher than the national average of about 1.1%. For more details, visit the Cook County Assessor’s Office.

Prognosis: Property taxes in Cook County are expected to continue rising due to ongoing financial challenges and the need to cover public service costs. However, reforms in budget management may help stabilize rates in the long term.

Hennepin County Property Tax

Hennepin County, which includes Minneapolis, has a lower property tax rate of around 1.25%. This makes the area more affordable compared to Cook County. If your home is valued at $250,000, you pay about $3,125 in property taxes annually.

Why Are Property Taxes Low in Hennepin County?

Hennepin County’s property tax rate of 1.25% is relatively low due to these key reasons:

- Diverse Tax Base: Revenue comes from various sources — 40% from residential properties and 60% from commercial and industrial properties. This balance reduces the burden on homeowners.

- Strong Local Economy: Major businesses contribute significantly to tax revenue. For example, commercial properties in the county generate over $400 million in taxes annually.

- Efficient Spending: Hennepin County maintains a balanced budget, keeping annual spending growth below 2%. This helps avoid large budget deficits.

Prognosis: Taxes are expected to remain stable, but rising infrastructure and public service costs could lead to slight increases of around 1-2% per year.

For more information, visit the Minnesota Department of Revenue.

NYC Property Tax

New York City has a distinctive property tax system, unlike many other parts of the country. The city classifies properties into four categories, each with its tax rate. This classification system helps balance the needs of residents and businesses while maintaining affordable housing and funding essential services. NYC’s tax structure is designed to support its large and diverse population while accounting for the differences between residential and commercial properties.

Here’s a breakdown of the four property classes:

- Class 1: One- to three-family homes.

- Class 2: Apartments and co-ops.

- Class 3: Utility properties.

- Class 4: Commercial properties.

The tax rate for residential properties in NYC is relatively low, which helps make housing more affordable. For example, the tax rate for a one-family home valued at $200,000 is 0.88%, meaning you would pay about $1,760 in property taxes annually.

On the other hand, commercial properties have a higher tax rate. The tax rate for a commercial property valued at $200,000 is 1.69%, so the annual tax would be around $3,380.

Why Are Residential Taxes Low and Commercial Taxes High?

The lower taxes on residential properties are intended to keep housing affordable in a city with a dense population. This approach helps prevent residents from leaving due to high living costs. Meanwhile, commercial properties are taxed at higher rates to generate additional revenue that helps fund public services, infrastructure, and the overall running of the city. The revenue from these higher commercial property taxes is crucial for maintaining NYC’s complex infrastructure and ensuring that services are available to all residents.

Prognosis: While residential property taxes in NYC are expected to stay relatively low, commercial property taxes could rise in the future. As NYC faces growing infrastructure needs and budget challenges, there may be increased pressure to raise taxes on commercial properties to meet those demands.

For more information, visit the NYC Department of Finance.

Alameda County Property Tax

In Alameda County, which includes Oakland, the property tax rate is about 1.16%. This means your property taxes are based on the market value of your home. If your home is valued at $250,000, your property taxes would be approximately $2,900 annually.

Why Are Taxes Moderate in Alameda County?

Here’s why property taxes are moderate in Alameda County:

- Diverse Properties: The county has residential, commercial, and industrial properties. This helps spread the tax burden so homeowners don’t pay all the taxes.

- Silicon Valley Economy: Alameda County is close to Silicon Valley, which brings in tax revenue from big tech companies and businesses. This helps keep taxes lower for residents.

- Stable Economy: The area has a strong economy with steady growth, which means there is consistent tax revenue without raising taxes too much.

- Smart Spending: The county manages its money well, so they don’t overspend and avoid large tax increases.

Prognosis: While property taxes might rise slightly in the future due to rising costs for services and infrastructure, the strong economy should help keep these increases small and gradual.

For more details, check out the Alameda County Assessor’s website.

Factors Affecting Property Tax Assessment

Several things can change how much you are charged in real estate taxes. We’ll break it down for you in simple terms:

- Property Value: The main thing that affects your property taxes is how much your property is worth. If your house becomes more valuable, like if the market prices increase, your taxes will increase. For example, if your home is worth $100,000 today and its value rises to $120,000, your taxes will also increase.

- Changes in Ownership or Improvements: When you buy a new property, the tax amount is based on the purchase price. So, if you buy a house for $300,000, your taxes will be calculated based on that amount. If you make big changes to your home, like adding a room or remodeling, the value of your property could go up.

- Regular Reassessments: Many counties review property values every few years. This is called a reassessment. If they find your property worth more, your property taxes could increase. So, even if you don’t change your home if the market in your area improves and home values rise, you might face higher taxes.

You can look at resources like the Property Tax Assessment Handbook for more details on how property taxes are assessed.

Tips for Managing and Reducing Property Taxes

There are exceptions to every rule, and this applies to all areas, including real estate. There are opportunities, known as exemptions, that can help reduce your taxes and save you some money. Let’s take a look at the most effective options.

Property Tax Appeals

If you think your property is being taxed too much, you can file an appeal. For example, if your home is assessed at $300,000 but believes it’s only worth $250,000, you can ask for your taxes to be calculated based on the lower value. This might reduce your tax bill.

Property Tax Appeals Process

We have prepared a simple guide on filing a property tax appeal so you can easily understand the process. Following these steps, you can submit your appeal and lower your property tax costs.

- Check your property’s value.

- Find the appeal deadline.

- Prepare your appeal.

- Submit your appeal.

- Attend the hearing (if required).

- Wait for the decision.

To learn more, check out resources like the Tax Appeal Guide.

Tax Deductions for Property Owners

Many states and counties have special tax deductions. Here’s a simple list of common property tax deductions and a quick explanation of each:

- Homestead Exemption: It reduces the taxable value of your home if it’s your main residence, which can lower your property tax bill.

- Senior Citizen Exemption: This program offers tax breaks to homeowners who are seniors (usually over 65). Depending on your location, this can include lower tax rates or full exemptions.

- Veteran Exemption: This program gives veterans, especially those with service-related injuries, a break on their property taxes.

- Disability Exemption: This reduces property taxes for homeowners with conditions like mobility issues or chronic illnesses, helping to lighten the load on their finances.

- Energy Efficiency Credits: You can receive tax credits or reductions for energy-saving home upgrades, such as solar panels or energy-efficient windows.

- Farm or Agricultural Land Exemption: Reduces property taxes for land used for farming or agricultural purposes to help make farming more affordable.

- Low-Income Housing Credits: Gives property owners tax breaks if they provide affordable housing to low-income tenants.

How to Claim These Deductions

You must apply through your local tax or assessor’s office for these deductions. You might need to provide proof, like showing your age, income, or disability status. It’s a good idea to check with your local government or a tax expert to ensure you get all your eligible deductions. Check out the American Property Tax Counsel for help with deductions and guide you through the process in your area.

Use a Property Tax Calculator

Many websites offer property tax calculators that let you estimate how much you’ll pay based on your home’s value and location. It’s a useful tool to help you plan and understand your tax situation. Try using tools like the SmartAsset Property Tax Calculator to understand your property tax costs.

Conclusion

Property tax rates in the U.S. depend on your property’s value and local tax rates, which vary by state and county. Areas like Cook County, Illinois (Chicago) have high property taxes, around 2.1%, while places like Hennepin County, Minnesota (Minneapolis) have lower rates, around 1.25%.

When picking a place to invest, consider areas with lower taxes, but also look at the economy, potential property value growth, and local amenities. High-tax areas like New York City and Cook County may offer more services and better infrastructure, but they can be more expensive in the long run. On the other hand, areas with lower taxes, like Hennepin County and Alameda County, California, may offer more affordable property costs. Still, you’ll need to ensure the area has strong growth potential.

To avoid overpaying, check your property’s assessed value regularly, especially in places with frequent reassessments like New York City, and appeal if it’s too high. Also, look for tax deductions or exemptions, such as homestead exemptions or senior discounts, that could help reduce your property tax bill.