Cyprus remains a leading destination for those looking to buy a house in Cyprus, with over 15,700 property transactions recorded in 2024. The island’s attractive tax system, Mediterranean lifestyle, and favorable mortgage options in Cyprus continue to draw investors and individuals seeking permanent or second homes. Houses are particularly sought after due to their strong potential for appreciation and the government’s incentives, including reduced VAT for first-time buyers.

In this Cyprus real estate guide, we will walk you through the essential steps of the legal process of buying property, provide insights into property taxes in Cyprus, and highlight key investment areas. According to the Cyprus Land Registry, the market remains robust, making now an ideal time to invest. Let’s begin.

Cyprus Real Estate Market Overview (2025)

The property market in Cyprus thrives, with strong demand from European, Middle Eastern, and Asian buyers. The island’s favorable tax policies, high rental yields, and residency incentives make it an attractive destination for investors and homeowners.

| Year | Total Property Transactions | Foreign Buyer Share | Market Growth Rate |

| 2022 | 13,409 | 30% | +8.2% |

| 2023 | 15,567 | 35% | +16.1% |

| 2024 | 15,797 | 38% | +1.5% |

| 2025 | Projected: 16,200+ | 40%+ | +2.3% |

Key Insights:

- According to the Cyprus Land Registry, Limassol and Paphos remain the top investment hotspots, accounting for over 60% of foreign property purchases.

- The Golden Visa program, digital nomad initiatives, and low corporate tax rates continue to attract high-net-worth individuals.

- Property prices have increased by 4.7% in urban areas and 3.2% in coastal towns compared to 2024.

- The demand for houses is rising, particularly among expats and retirees, due to Cyprus’ favorable climate, affordability, and EU residency advantages.

With steady growth and strong foreign interest, Cyprus remains a prime destination for property buyers in 2025. If you're comparing options within the island, take a closer look at the Best Neighbourhoods For Families in Nicosia, where long-term value and lifestyle often go hand in hand.

How Long Does It Take to Buy a House in Cyprus?

The timeframe for buying a house in Cyprus ranges from 2 to 6 months, depending on legal approvals, financing, and negotiations. Local buyers usually complete the process within 2 to 4 months. In contrast, non-EU buyers often face additional steps, such as obtaining approval from the Council of Ministers, which can extend the timeline.

General Timeline

| Stage | Duration | Details |

| Finding a House | 2–8 weeks | Searching through real estate agencies and online listings. |

| Legal Checks | 4–6 weeks | Ensuring clear title deeds, no outstanding debts, and compliance with zoning laws with the Department of Lands and Surveys. |

| Approval Process | 4–8 weeks | Non-EU buyers need permission from the Council of Ministers. |

| Finalizing Sale | 1–2 weeks | Signing contracts, transferring funds, and registering the property. |

Let’s say, a British buyer purchased a villa in Paphos for €450,000. The legal checks took 7 weeks, and the Council of Ministers’ approval lasted 6 weeks, leading to a total completion time of 5 months.

Key and Time-Consuming Stages in the Legal Process of Buying Property in Cyprus

While finding a house for sale in Cyprus is a relatively straightforward process — especially with the help of a professional real estate agency — the legal procedures involved in purchasing property can be more time-consuming. Below is a detailed breakdown of the most crucial legal steps and their expected durations.

Legal Checks (4-6 weeks)

Before proceeding with a purchase, a comprehensive legal review must confirm that the property is free of debts, encumbrances, and legal disputes. This due diligence process includes:

- Title deed verification — Ensuring the property has a clear title and is properly registered in the Department of Lands and Surveys. In high-demand locations like Limassol, newer developments typically have clearer documentation, whereas older properties or those with complex inheritance claims may require additional legal work, potentially extending the timeline.

- Zoning and planning compliance — Checking that the property aligns with urban planning laws and that there are no restrictions on renovations or expansions.

- Outstanding financial obligations — Ensuring that the property is debt-free, meaning no unpaid taxes, mortgages, or claims from previous owners.

Council of Ministers’ Approval for Non-EU Buyers (4-8 weeks)

Non-EU citizens must obtain Council of Ministers' approval before purchasing a property. This step ensures compliance with national property ownership regulations and can take anywhere from 4 to 8 weeks, depending on the case. The approval process involves:

- Submitting an application detailing the property, its intended use, and the buyer’s financial background.

- Government review to confirm the transaction does not conflict with national interests or property ownership laws.

While EU citizens are exempt from this requirement, non-EU buyers — particularly those acquiring large properties or purchasing for investment purposes — may experience longer processing times.

Finalizing the Sale (1-2 weeks)

Once all legal checks and approvals are in place, the final steps involve signing the sales agreement, transferring funds, and registering the property. Typically, this phase is completed within 1-2 weeks, but potential delays can occur due to:

- Bank processing times — International wire transfers can take longer, especially for non-EU buyers needing currency exchange approvals.

- Last-minute negotiations — Price adjustments, repair requests, or additional contract clauses may prolong the closing process.

- Land Registry registration — While the process is usually straightforward, an influx of property transactions may cause minor administrative delays.

Expert Tip

To avoid unnecessary delays, work with a lawyer who can:

- Ensure all legal checks are completed efficiently.

- Handle the Council of Ministers’ approval process on your behalf.

- Facilitate a smooth closing by coordinating with banks and government agencies.

By understanding these critical legal steps, buyers can better navigate the property purchase process and secure their home in Cyprus with minimal delays.

How Much Money Do You Need to Buy a House in Cyprus?

Purchasing a house in Cyprus requires careful financial planning beyond just the property price. Buyers must account for taxes, legal fees, and government charges, depending on property type, value, and buyer status (EU vs. non-EU). Below is a detailed breakdown of the key costs involved.

To better understand the long-term expenses, it’s also worth reviewing the Cyprus Property Tax Secrets: What Every Buyer Must Know article.

Key Property Purchase Costs in Cyprus

| Cost Component | Percentage / Amount |

| Down Payment | 10–30% of property price (varies by mortgage terms) |

| Transfer Tax | 3–8%, based on property value |

| VAT | 19% (new properties) / 0% (resale properties) |

| Legal Fees | €1,500–€3,000, depending on property complexity |

| Stamp Duty & Registration | 0.15–0.2% of property value |

Down Payment (10–30%)

The down payment typically ranges from 10% to 30% of the property price. Buyers using mortgage financing need at least 20% upfront, while cash buyers avoid financing-related costs.

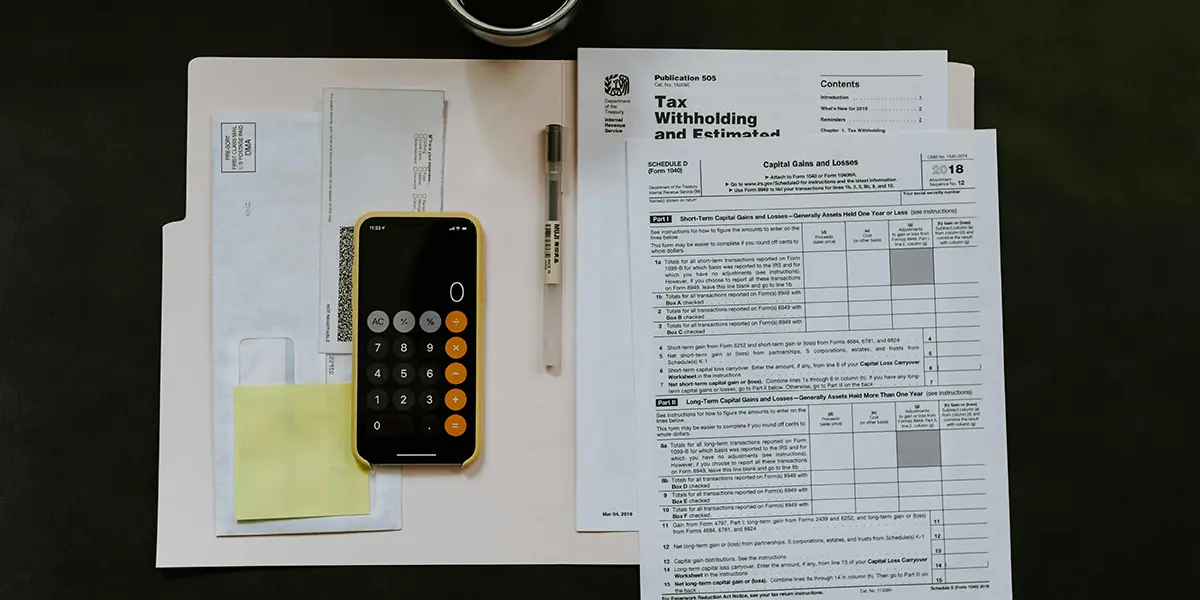

Transfer Tax (3–8%)

Applicable to resale properties, transfer taxes on property in Cyprus depend on its value:

- Up to €85,000 → 3%

- €85,001 – €170,000 → 5%

- Above €170,000 → 8%

The official Department of Lands and Surveys provides a Transfer Fees Calculator on their portal for accurate calculations of property transfer fees in Cyprus. For a €500,000 house, the Transfer Tax is calculated as:

- €85,000 x 3% = €2,550

- €85,000 x 5% = €4,250

- €330,000 x 8% = €26,400Total: €33,200

VAT (19%) on New Properties

A 19% VAT applies for newly built homes, significantly increasing the final cost. However, first-time buyers may qualify for a reduced VAT rate of 5% on the first 200m² of a primary residence.

Legal Fees (€1,500–€3,000)

Hiring a real estate lawyer is essential for contract drafting, title checks, and transaction security. Fees typically range between €1,500 and €3,000, depending on property complexity and additional legal work (e.g., title deed corrections, inheritance issues).

Stamp Duty & Registration (0.15–0.2%)

A stamp duty tax applies to all property purchases:

- Up to €5,000 → Exempt

- €5,001–€170,000 → 0.15%

- Over €170,000 → 0.2%

Additional Costs to Consider

- Mortgage Arrangement Fees — Up to 1% of the loan amount.

- Real Estate Agent Commission — Typically 3–5% (paid by seller, but negotiable).

- Property Insurance — €300–€1,000/year, required for mortgage buyers.

- Annual Property Taxes — Based on municipal rates and property size.

Example Cost Calculation

Below is a breakdown of expected costs for different property price points, including mandatory taxes and legal expenses.

| Property Price | €200,000 | €500,000 |

| Down Payment (20%) | €40,000 | €100,000 |

| Transfer Tax | €9,200 | €33,200 |

| VAT (19%) | €38,000 | €95,000 |

| Legal Fees | €2,000 | €2,500 |

| Stamp Duty (0.2%) | €400 | €1,000 |

| Total Cost | €289,600 | €731,700 |

Expert Tip

To reduce upfront costs, consider resale properties (exempt from VAT), negotiate legal and agent fees, and apply for the 5% VAT reduction for primary residences. Working with experienced real estate professionals ensures a transparent and smooth transaction.

Can You Buy a House in Cyprus with No Residency?

Foreign buyers, including non-residents, can legally purchase property in Cyprus. However, specific regulations, required documents, and potential residency benefits must be considered. This expat guide to buying a house in Cyprus outlines the essential information you need.

Rules and Restrictions for Foreign Buyers:

- EU/EEA Citizens: No restrictions; they can purchase property in Cyprus without limitations.

- Non-EU Citizens: Must obtain approval from the Council of Ministers before completing the purchase. This process typically takes 3–6 months and requires proof of financial means and a clean legal record.

Documents Required for Buying a House Without Residency

Non-EU buyers must submit the following documents:

- Notarized copy of passport.

- Bank reference letter (proving financial stability).

- Purchase agreement (signed with the seller).

- Proof of funds (bank statements or income sources).

- Application for Council of Ministers’ approval.

Detailed information and the application form (COMM 145) can be found on the Cyprus Ministry of Interior's website.

Can Buying Property Lead to Residency in Cyprus?

Yes, purchasing property in Cyprus can lead to residency under specific programs. These residency options are available primarily through property investment, offering high-net-worth individuals and investors the chance to establish a foothold in Cyprus.

For a full breakdown of the steps and documents, see our guide on How to Move to Cyprus from the UK in 2025, which covers the process in real terms.

1. Permanent Residency via Investment (Fast-Track) – "Golden Visa"

- Minimum Property Investment: €300,000 + VAT for a new residential property.

- Additional Financial Requirements: The investor must show an annual income of at least €30,000 (from abroad), with additional income needed for dependents and parents.

- Processing Time: 2-3 months.

- Path to Citizenship: After 7 years of legal residence, an individual may apply for Cypriot citizenship.

Benefits:

- Indefinite residency for the investor and their family (spouse, children under 25, parents).

- Travel freely within the EU.

- No minimum stay requirement, but the investor must visit Cyprus once every two years to maintain residency.

2. Permanent Residency via Category F (Standard Procedure)

- Minimum Property Investment: Typically €100,000 or more, though no specific amount is mandated.

- Additional Financial Requirements: Proof of sufficient income from abroad to support the applicant and their family without needing employment in Cyprus.

- Processing Time: Approximately 12+ months.

Benefits:

- Permanent residency for the applicant and their family.

- Does not lead to citizenship directly but offers long-term residence rights.

Does Property Purchase Automatically Grant Residency?

No, simply purchasing property in Cyprus does not automatically grant residency. However, property investment can be a direct pathway to Cyprus Permanent Residency through the Golden Visa or Category F programs, making Cyprus an attractive destination for those looking to live, work, and invest within the EU.

How Buyers Benefit from Residency in Cyprus

A Canadian investor purchased a €320,000 apartment in Paphos and applied for permanent residency through the Cyprus Golden Visa Program. The application was approved within two months, allowing the buyer and their family to live in Cyprus indefinitely and travel within the EU.

While residency is not a prerequisite for purchasing property in Cyprus, property investment can be a strategic pathway to obtaining it.

How to Buy a House in Cyprus on a Budget

You don’t need a massive budget to own a home here. With the help of tools like Anisad offers, which allows you to customize property listings by region, budget, and number of bedrooms, you can streamline your search, saving time and money. For example, you can browse affordable houses in Larnaca or check budget-friendly villas in Paphos on Anisad to see what’s available under €300,000. Let’s break down practical steps to help you buy a house in Cyprus without overspending.

Set a Clear Budget and Stick to It

When buying property in Cyprus, setting a realistic budget is crucial. Down payments are usually between 10% to 30% of the property price, depending on the value and the mortgage terms. For example:

- €200,000 property: Down payment would be €20,000–€60,000.

- €500,000 property: Down payment would be €50,000–€150,000.

In addition to the down payment, you’ll need to account for transfer tax (3% to 8%), VAT (5% for new properties), and legal fees (typically €1,500–€3,000). Including these costs, a €200,000 property could cost an additional €25,000–€30,000 in taxes and fees. For a €500,000 property, expect €50,000–€60,000 in additional costs.

By defining your budget, you’ll avoid getting excited about properties outside your price range and ensure you can afford all the associated costs.

Use Online Platforms and Agents Specializing in Budget Properties

Anisad can help you filter listings based on specific criteria such as price, location, and bedroom count, saving you time by presenting only the most relevant properties. For instance, if you're looking for a 2-bedroom apartment in Paphos with a budget of €150,000, you can quickly narrow down options and avoid wasting time on properties that exceed your budget.

Negotiate the Price

Negotiation is a key element when buying a house in Cyprus. Sellers are often willing to negotiate, especially if a property has been on the market for several months or is in a less sought-after area. For example:

- A €200,000 property could be reduced by €10,000–€15,000.

- A €500,000 property might see a €25,000–€40,000 reduction.

You can secure a better deal if you negotiate in areas like Larnaca or Famagusta, where demand is lower. Sellers in these areas are typically more flexible with price to close the deal quickly.

Explore Properties in Less Expensive Areas

While cities like Limassol or Paphos are the go-to for many international buyers, you can find excellent deals in Famagusta, Polis Chrysochous, and Larnaca, where property prices are considerably lower. For example:

- A 2-bedroom apartment in Famagusta may cost around €120,000–€150,000. You can find listings that match these prices on Anisad’s platform, such as apartments in Famagusta that fall within this budget range.

- A 3-bedroom villa in Polis Chrysochous could be priced between €250,000–€350,000.

By looking outside the major cities, you can find properties that offer similar amenities and proximity to the beach at a much lower cost.

Take Advantage of First-Time Buyer Benefits

Cyprus offers various benefits for first-time property buyers, which can help save money. For example:

- VAT Reduction: First-time buyers on a new home under €300,000 can apply for a reduced VAT rate of 5% instead of 19%. For a €250,000 property, this means saving €35,000.

- Transfer Tax Discount: First-time buyers also benefit from a reduced transfer tax rate of 3% for properties up to €85,000 and 5% for properties above that. For a €200,000 property, this could mean €10,000 in savings on transfer tax.

If you're eligible, these savings can reduce your overall cost and make your property purchase even more affordable.

The Step-by-Step Process of Buying a House in Cyprus

We’ve already covered the key points — budget planning, legal requirements, and property search strategies. Now, let’s break down the full process into clear and simple steps.

- Set Your Budget — Factor in the down payment (10–30%), taxes (3–8% Transfer Tax, 5–19% VAT), and legal fees (€2,000–€5,000). Knowing the total cost upfront helps avoid surprises.

- Find the Right Property — Platforms like Anisad let you filter listings by region, price, and number of bedrooms, saving you time and money. You can choose between bustling cities like Limassol or more affordable areas like Larnaca.

- Legal Checks & Due Diligence — A lawyer verifies title deeds, debts, and zoning compliance. This takes 4–6 weeks but ensures you buy a legally sound property.

- Sign the Contract & Secure Financing — Once the legal review is complete, sign the sales contract, register it, and finalize payments or mortgage arrangements.

- Final Approvals & Property Registration — Non-EU buyers need Council of Ministers' approval (4–8 weeks). After approval, the property is officially registered, and you receive the keys and ownership documents.

Following these steps ensures a smooth and hassle-free home-buying experience in Cyprus.

Common Mistakes When Buying a House in Cyprus — and How to Avoid Costly Losses

Even experienced buyers can make costly mistakes when purchasing property in Cyprus. Here are some warning signs and tips for avoiding losing thousands due to poor planning.

Skipping Legal Checks Can Delay or Block Ownership

Failing to conduct due diligence can lead to legal roadblocks. Unpaid taxes, inheritance disputes, or missing title deeds can stall or cancel a sale. Let’s say a buyer in Larnaca purchased a property, only to discover an unresolved mortgage claim. The legal battle delayed ownership transfer by six months and cost an additional €8,000 in legal fees.

Solution: Always hire an independent real estate lawyer to verify the title deed, outstanding debts, and ownership history before signing.

Underestimating Taxes and Hidden Fees Leads to Financial Strain

Focusing only on the house price and ignoring taxes on property in Cyprus can result in unexpected expenses. Buyers must account for VAT (up to 19%), Transfer Tax (3–8%), legal fees (€2,000–€5,000), and stamp duty.

Solution: Request a full cost breakdown from your lawyer before proceeding and check government fee calculators to estimate expenses accurately.

Rushing the Purchase Without Research Can Cost 5–10% More

Emotional decisions often lead to overpaying. Buyers eager to close deals quickly overlook seasonal price trends, local market fluctuations, and negotiation opportunities. It’s like a Swedish couple bought a villa in Paphos during peak season without negotiating, later realizing prices drop 5–10% off-season — a potential €20,000 savings lost.

Solution: Compare property values, negotiate aggressively, and time your purchase to maximize savings.

Ignoring Location Growth Potential Limits Investment Returns

Choosing a property based only on current prices — without assessing future value growth, rental demand, or planned infrastructure — can lead to stagnating or declining returns.

For example, a buyer purchased a rural apartment near Nicosia, expecting appreciation. However, prices remained stagnant due to low rental demand and limited transport links while properties in Limassol and Larnaca grew 4–7% annually.

Solution: Research government development plans, nearby projects, and local rental demand to choose high-growth areas.

Final Thoughts: A Smart Approach to Buying Property in Cyprus

Buying a house in Cyprus is a rewarding investment, but making the right choice requires careful planning and informed decisions. Throughout this guide, we’ve covered budgeting, legal processes, and common pitfalls, helping you understand what to expect at every stage.

With foreign buyers accounting for 38% of transactions in 2024 and property prices rising 4.7% in cities and 3.2% in coastal areas, Cyprus remains a prime real estate destination. Investors can benefit from 5-7% rental yields in sought-after locations, making property ownership a lifestyle upgrade and a financial opportunity.

For those looking beyond investment, purchasing property can also lead to residency, with the Golden Visa program requiring a €300,000 investment. To find the best deals within your budget, Anisad simplifies the search by curating listings based on region, price, and property size — saving you time and money. With expert guidance and thorough research, your Cyprus home can be a secure and profitable purchase.